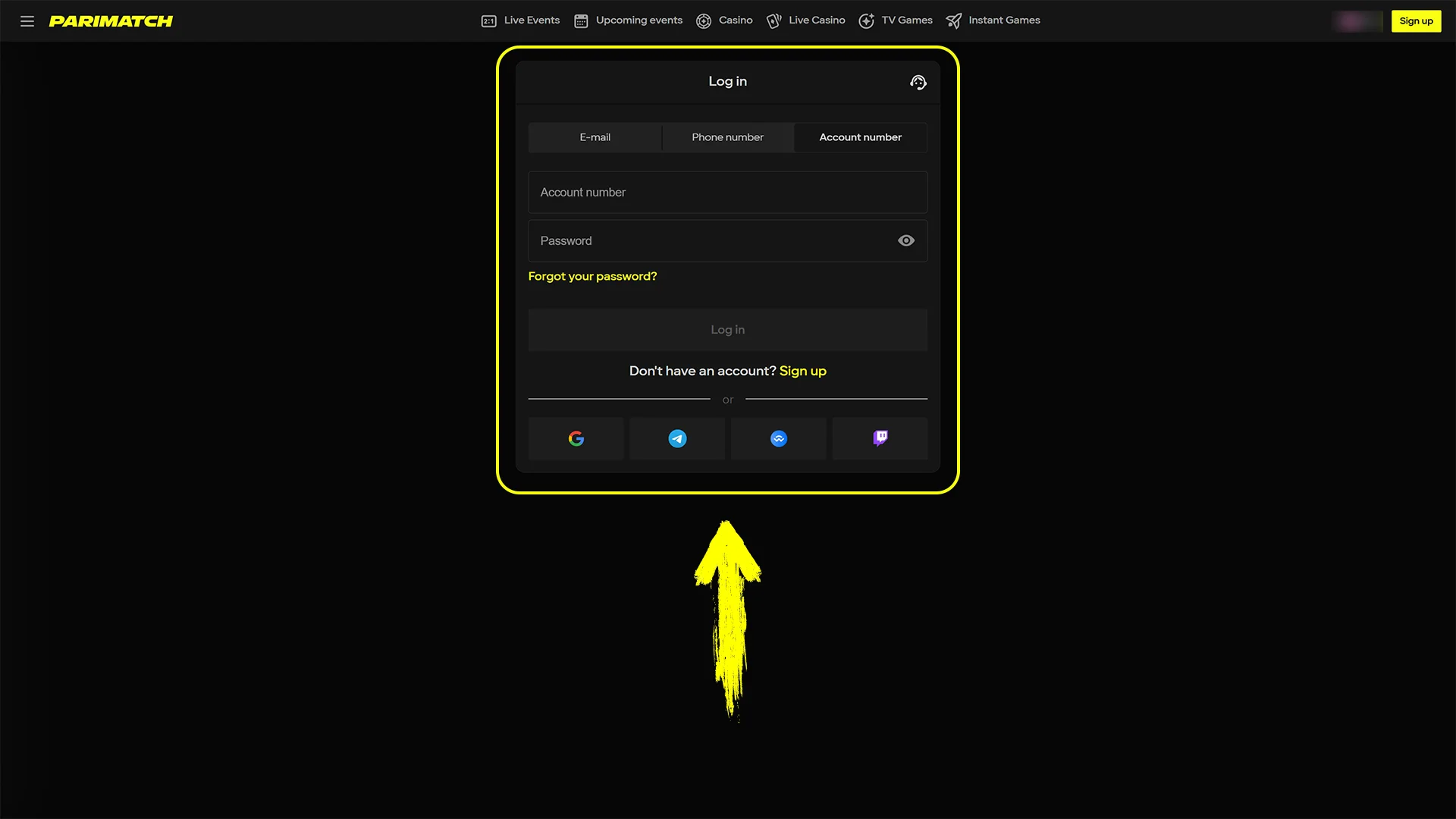

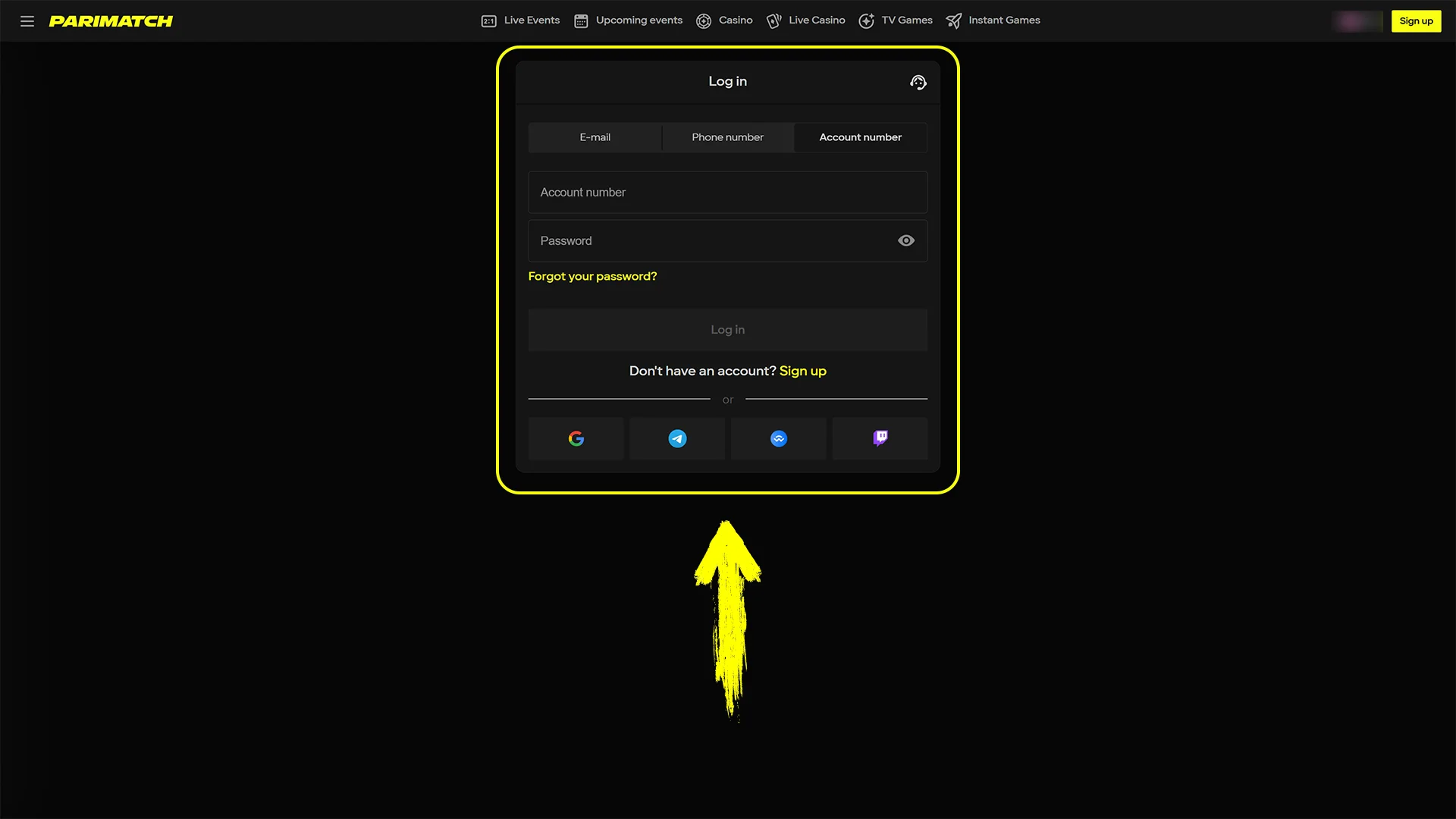

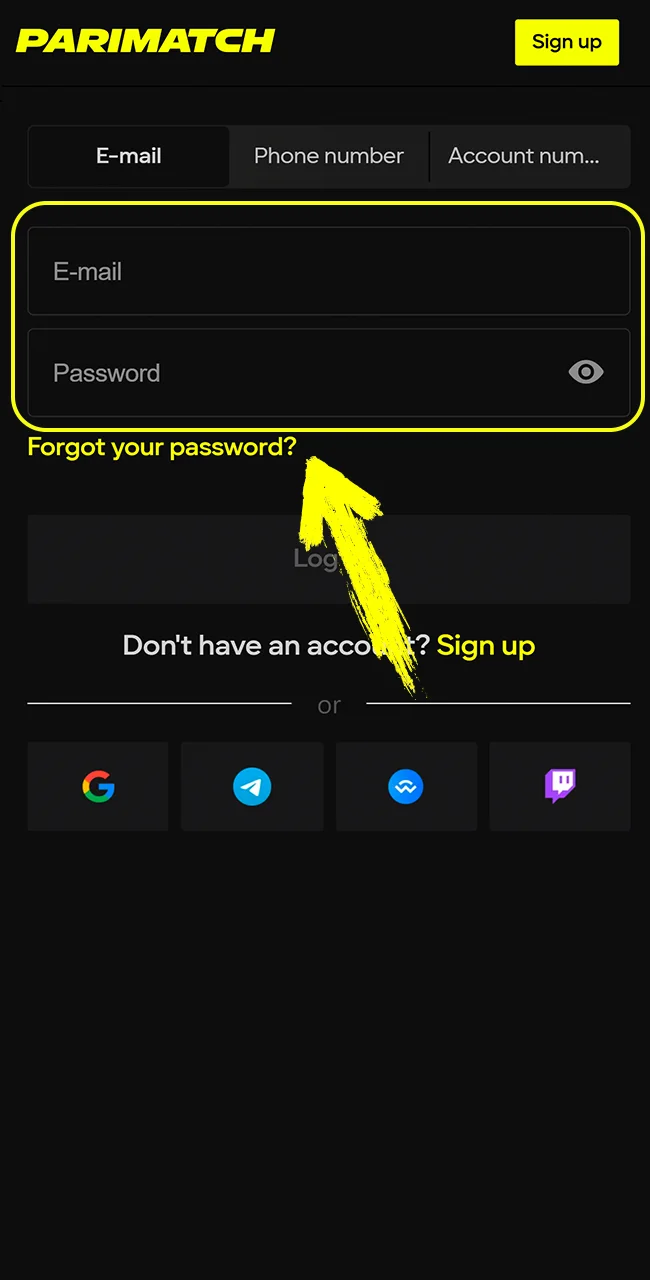

Log In to Your Account

Enter your email or phone number and password to access your Parimatch profile.

At Parimatch, we offer a variety of withdrawal methods so that our players in India can receive their winnings quickly and securely. The platform supports transactions in INR and offers several convenient local methods, including UPI, PayTM, and PhonePe. Withdrawals can be made at any time via the desktop website or mobile app.

Parimatch provides players with several reliable withdrawal methods designed for speed and convenience. You can withdraw your winnings directly to your mobile wallet or bank account. All methods ensure secure payment processing and support the INR currency. Learn more about the available payment methods and their Parimatch India withdrawal limits:

| Payment System | Min. Withdrawal (INR) | Max. Withdrawal (INR) | Processing Time | Fees |

| UPI | 500 | 150,000 | Within a day | – |

| PhonePe | 500 | 150,000 | Within a day | – |

| PayTM | 500 | 150,000 | Within a day | – |

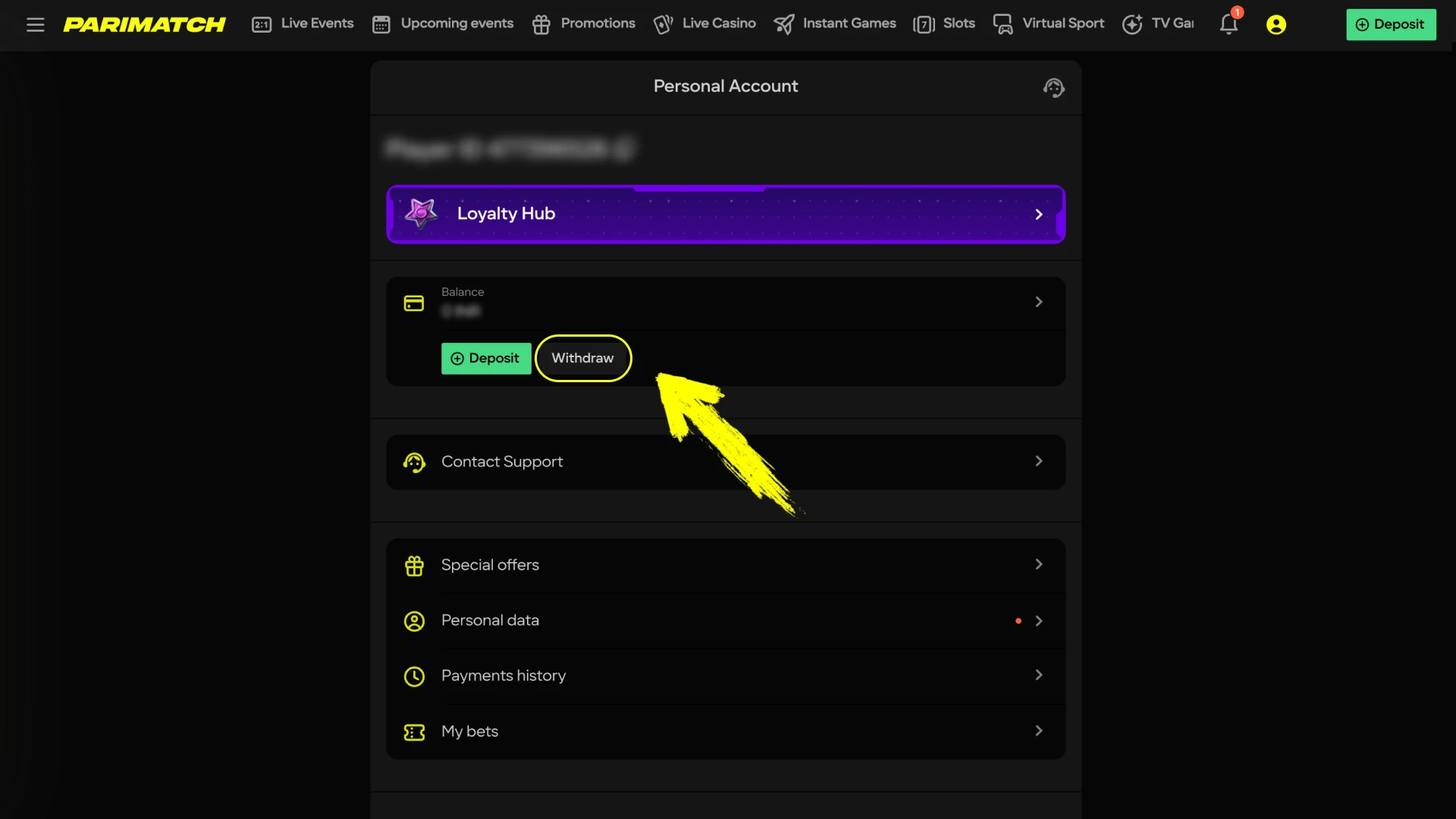

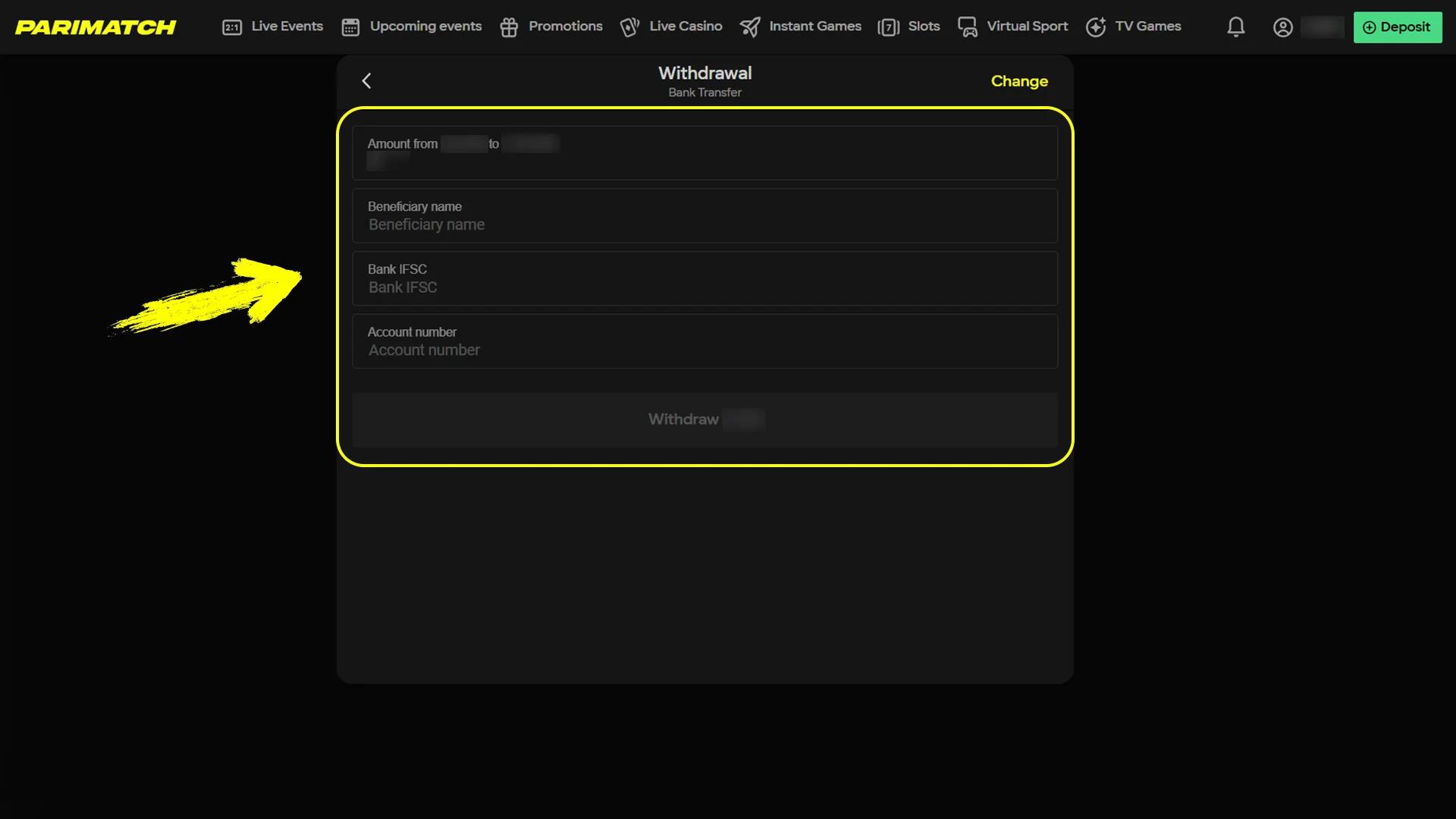

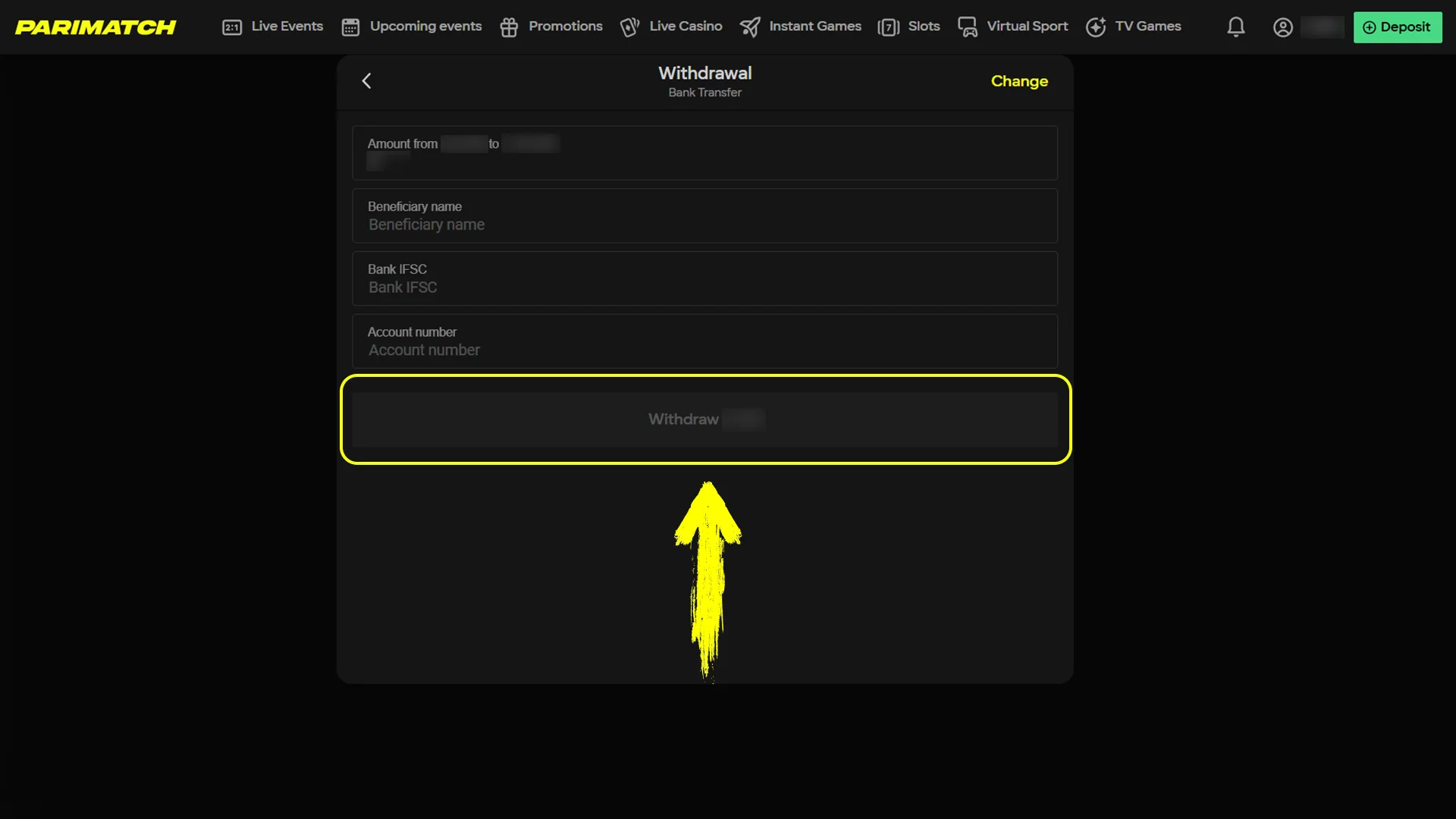

Withdrawing money from your Parimatch account is a simple and straightforward process that takes just a few minutes. Follow the steps below to complete your withdrawal successfully:

Enter your email or phone number and password to access your Parimatch profile.

Go to your account dashboard and click “Withdrawal” to open the transaction menu.

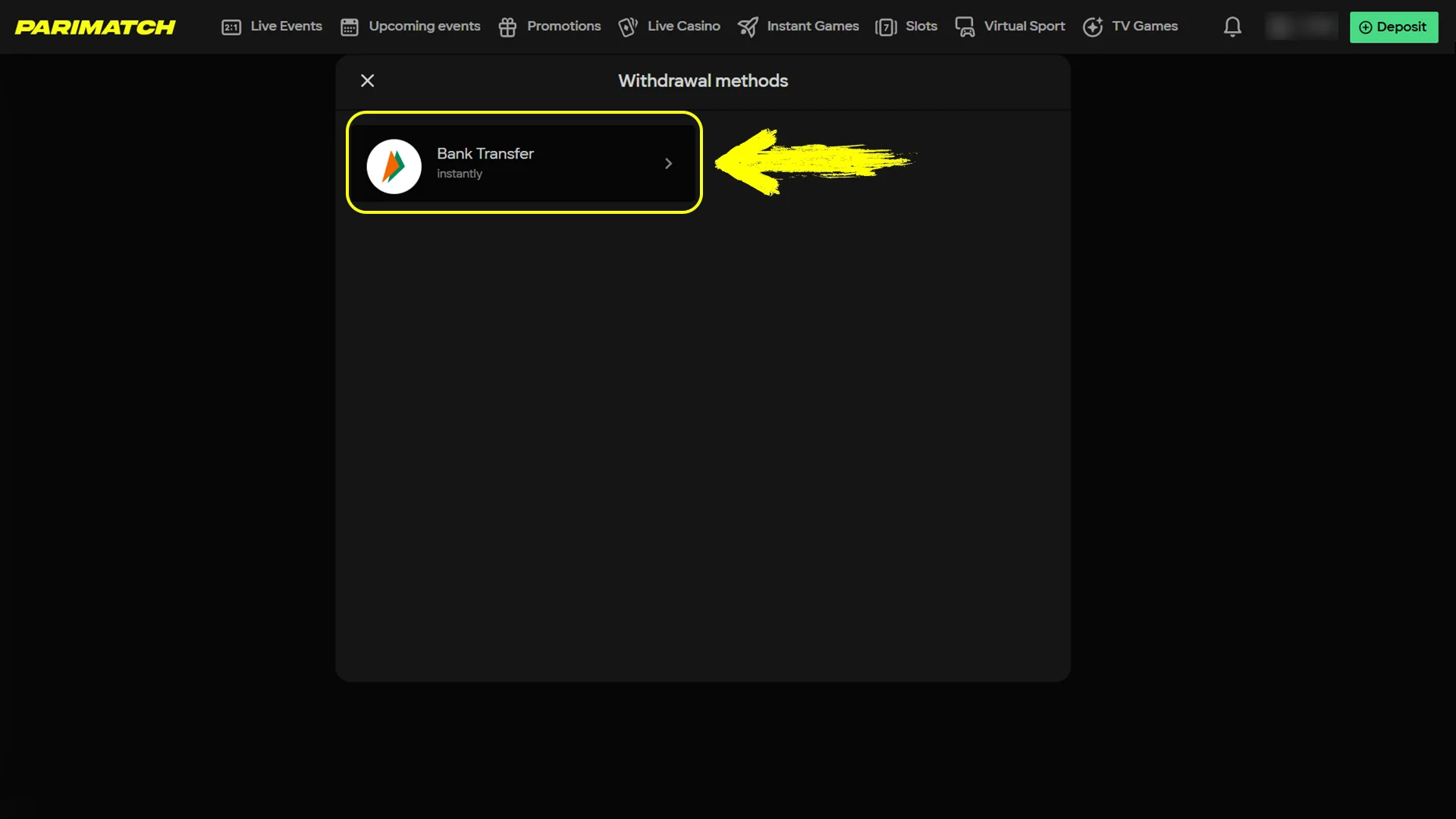

Select one of the available options such as Tigo Pesa, Airtel Money, or Halo Pesa.

Specify the withdrawal amount, check your wallet or account number carefully, and confirm.

Click “Confirm” to send your withdrawal request. Funds will be processed instantly for mobile money and within one business day for banks.

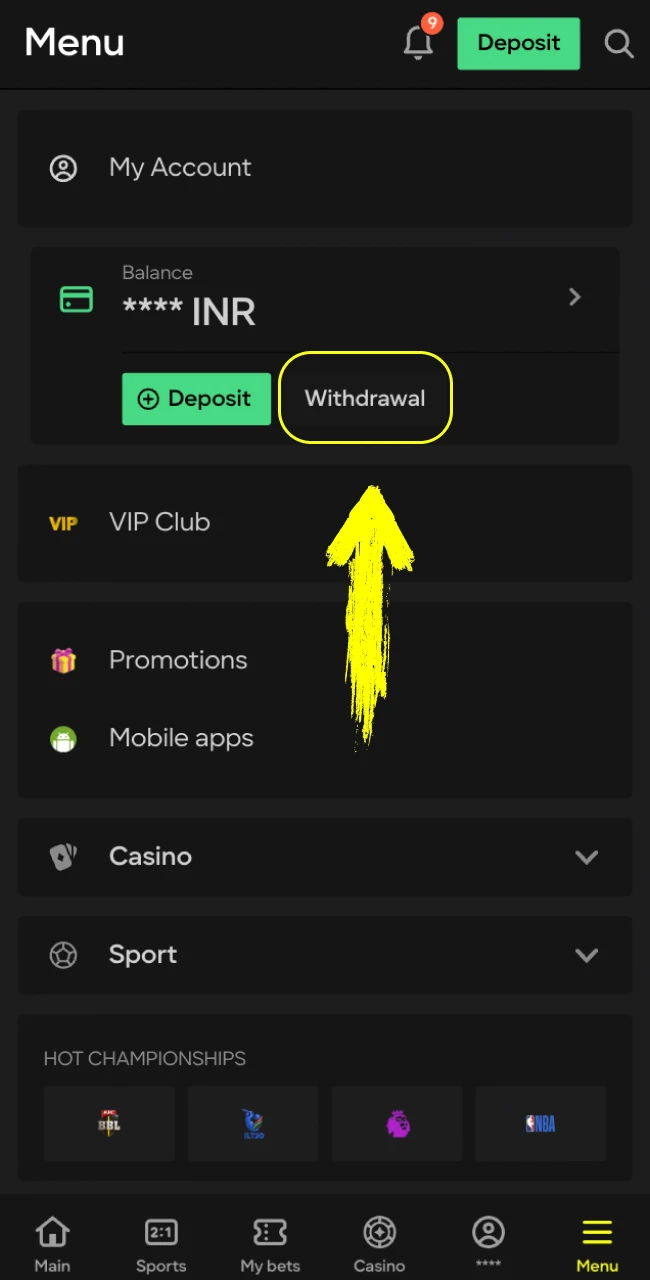

The Parimatch mobile app makes withdrawing your winnings quick and easy. The process is almost identical to the desktop version but optimized for smaller screens. Follow the step-by-step guide below to withdraw directly from your smartphone:

Launch the Parimatch app on your Android or iOS device and sign in using your registered email and password.

Tap on your profile icon or open the side menu, then select “Withdrawal” from the list of options.

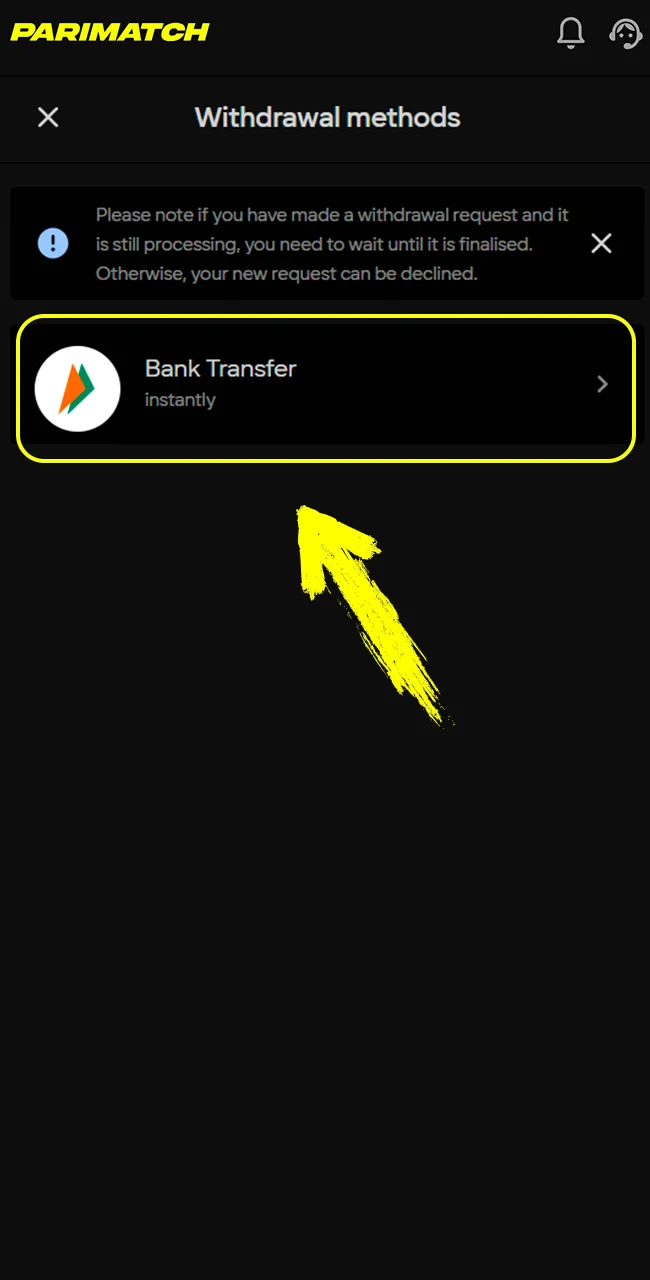

Choose one of the supported withdrawal methods and tap on it.

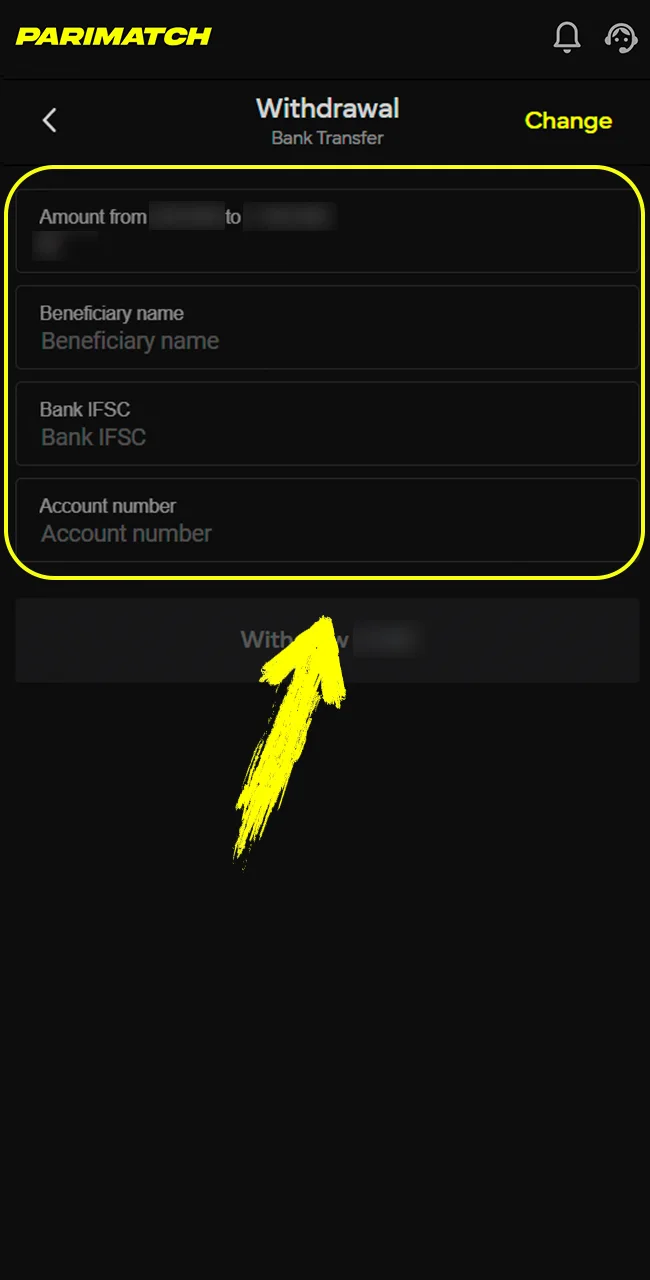

Specify the withdrawal amount and verify your mobile wallet or account number before confirming the transaction.

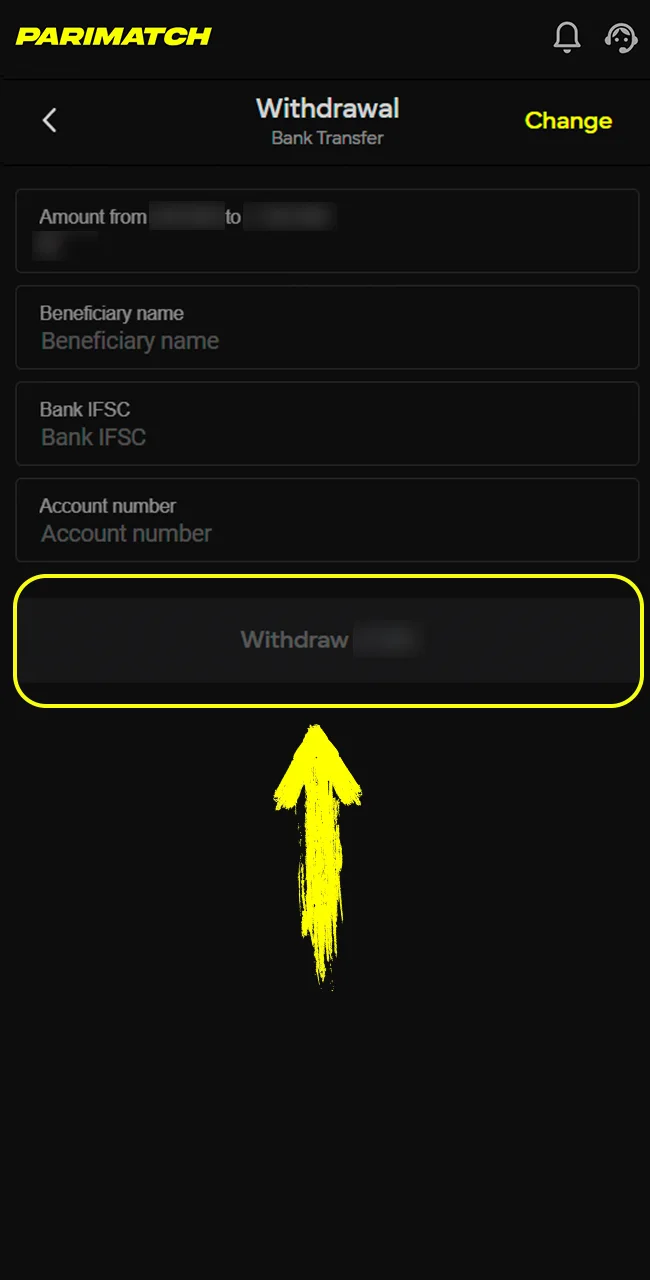

Tap “Confirm” to submit the request. You’ll receive a notification once your withdrawal is approved. Most mobile money transactions are processed within minutes.

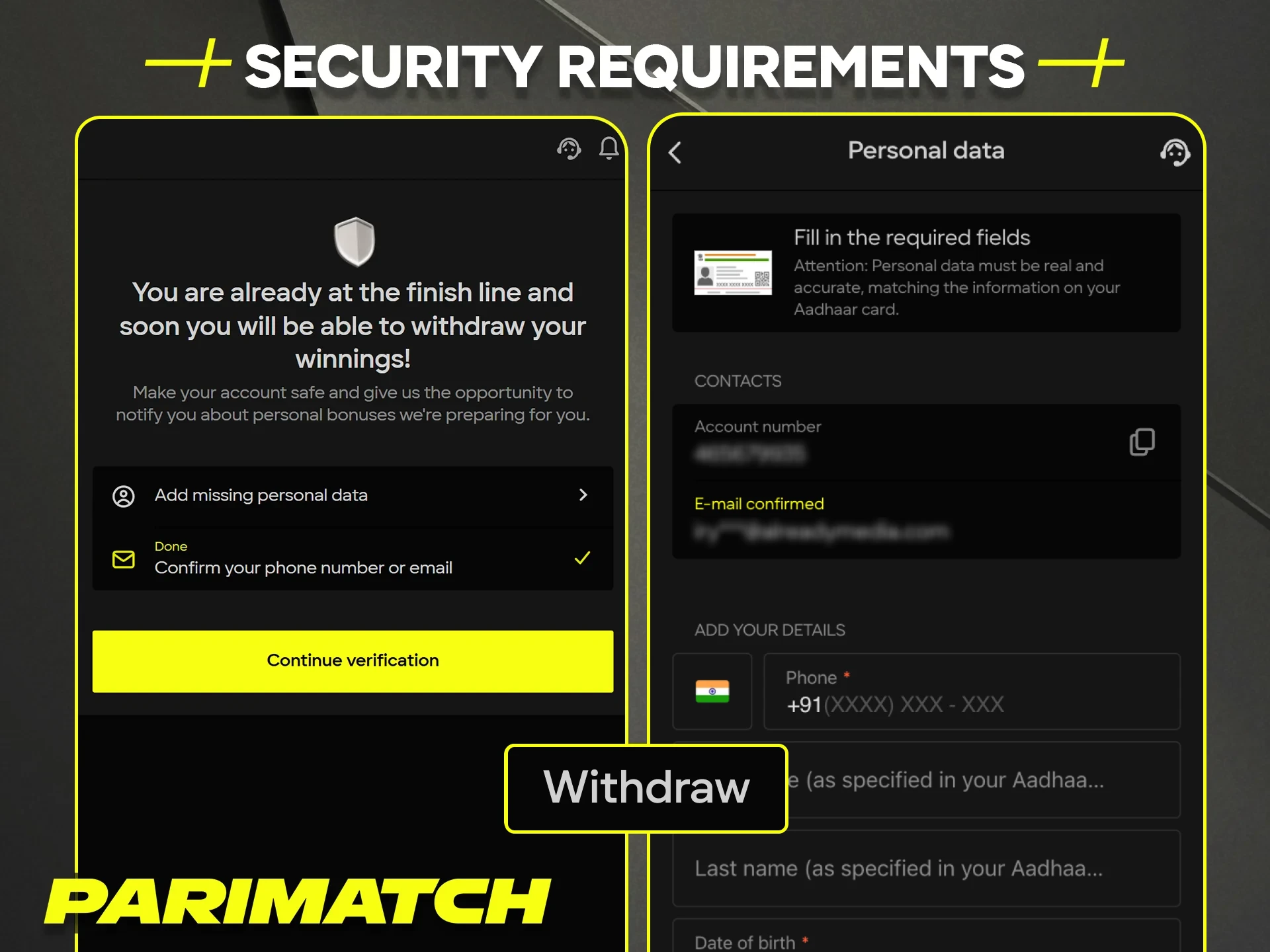

Before making your first withdrawal from Parimatch, you must verify your account. This process, known as KYC, ensures your identity is authentic and helps prevent fraud or unauthorized access. Verification also speeds up future transactions and increases withdrawal limits.

Here’s what you’ll need to complete verification:

Once your documents have been approved, you will receive confirmation by email or SMS, and your withdrawal will be processed without delay.

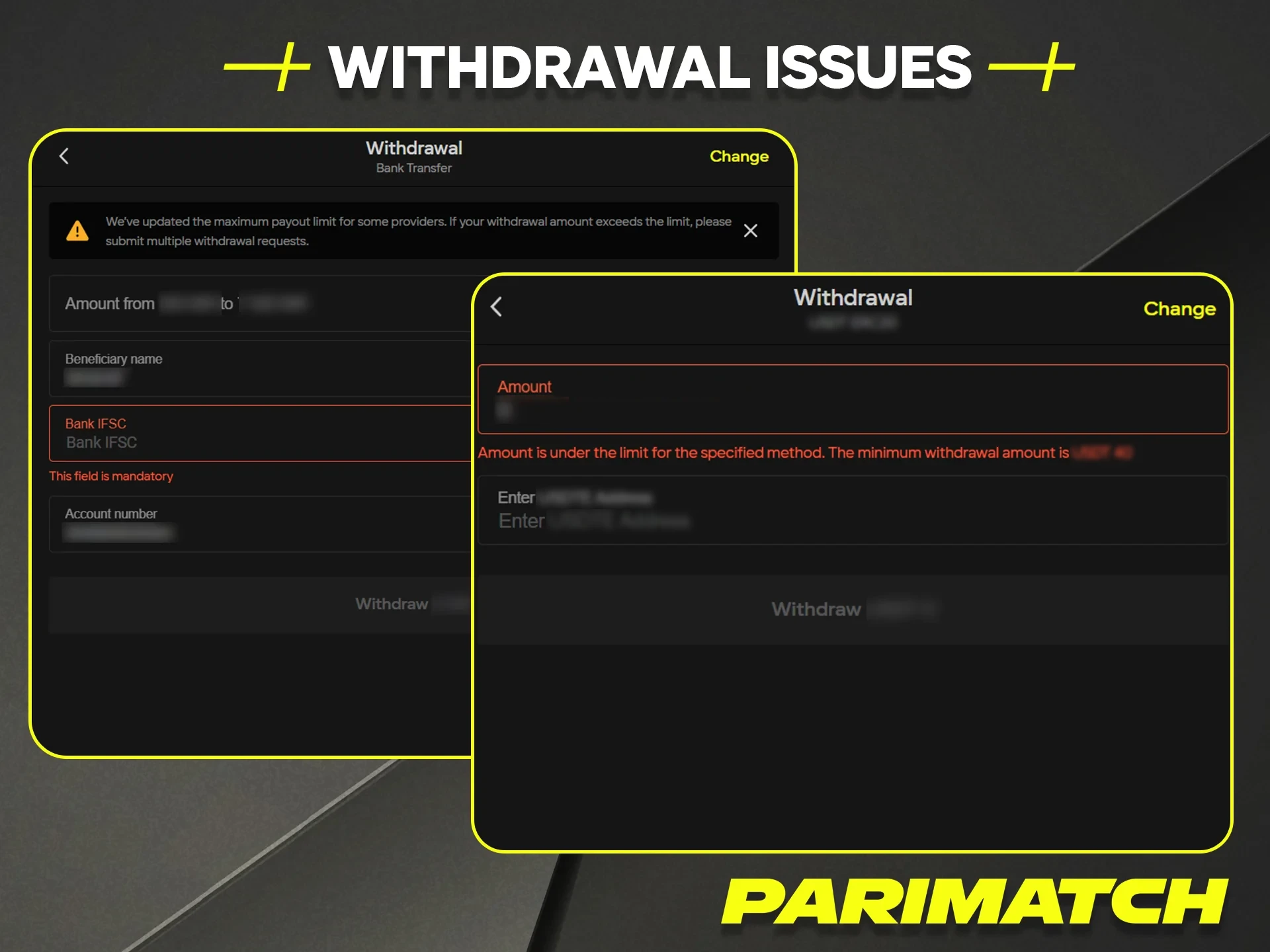

Although Parimatch withdrawals are usually processed quickly, delays or errors can sometimes occur. Below are some common issues that players encounter and easy ways to resolve them:

If the problem persists, contact Parimatch support via Live Chat or email.

The Parimatch minimum withdrawal amount varies by method, but typically starts from 500 INR. Check the payment section in your account for the exact limits.

Parimatch withdrawal time depends on the load of the server, it may take from several minutes to 11 hours.

Parimatch does not charge withdrawal fees. However, your payment provider may apply a small transaction fee depending on their policy.

For security reasons, all withdrawals should be made using the same method and account used for deposits.

Updated: